After months of enormous shortages in availability, there are currently indications of a stabilization and, for the time being, no further shortages of the raw material wood. For the fourth quarter of 2021, DEUFOL expects a slight easing of the markets, but overall a stabilization at a high level. All important information on the current market situation, the recent drivers of the development and a forecast on how the market might develop in the near future can be found in this blog article.

The availability of wood is increasing again

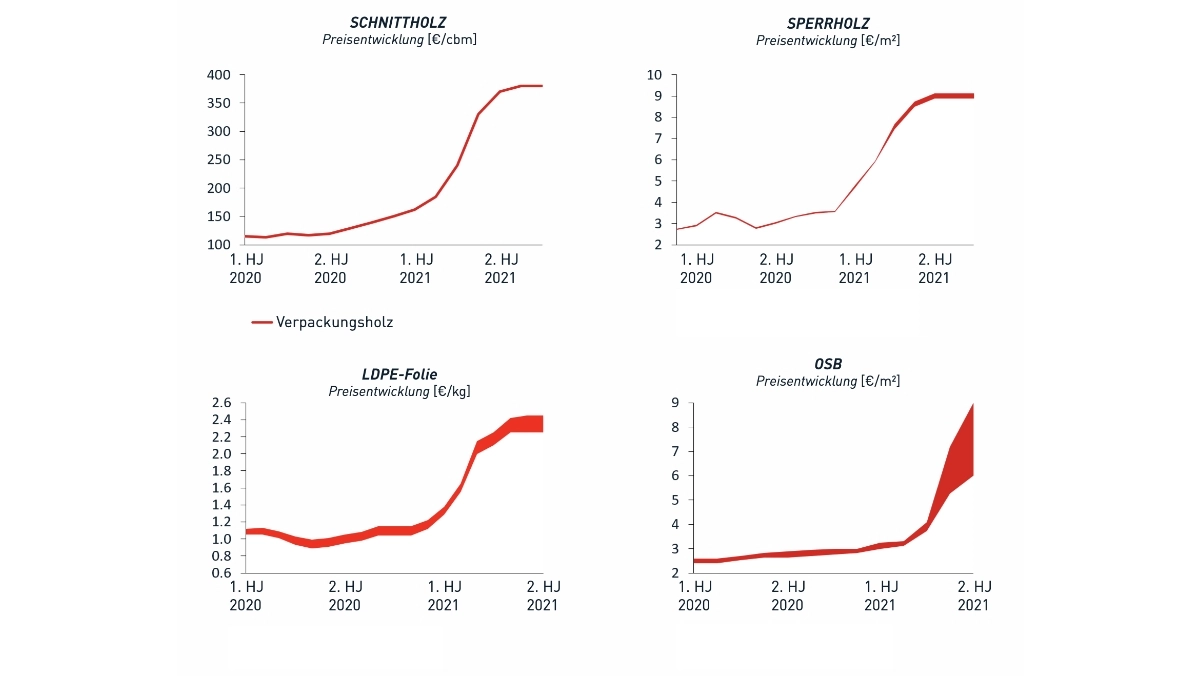

As the American market can now be supplied locally to a higher extent again, the demand for wood, especially from the United States of America, is slightly declining overall. Following the impact of COVID-19, sawmills in the USA have been able to ramp up operations again and are now able to maintain some domestic supply. However, due to the highly exaggerated demand situation in recent months, there was a catch-up effect in stockpiling as some industries were temporarily unable to obtain wood. Furthermore, the price of sawn timber is currently being negatively impacted by sharply rising log prices and the global peak in freight rates. Thus, although the current sentiment on the market is more positive, however, prices are still consolidating at a high level.

The market for commodities is recovering and the situation has become more settled

The market situation seems to be stabilizing at the moment and does not seem to be heading for new crisis levels. For the fourth quarter of 2021 at least, we at DEUFOL expect a slight easing of availability, as on the one hand demand for imported wood in the USA is falling ( decreasing COVID figures; increasing own production) and on the other hand European sawmills are now slowly restocking their inventories.

Conversely, however, the increased transport costs for the import of panel material and the soaring prices for roundwood have had a negative impact. The development of the situation in the coming months and especially in 2022 therefore still remains to be seen and requires a respective adaptability in order to continue to be able to react flexibly.

With the right contact person proactively and efficiently through the crisis

In order to ensure our ability to deliver, we have gradually increased inventories at great expense over the past few months in order to guarantee our availability. In the meantime, these stocks are being worked off and reduced to a normal level, although this is still associated with increased costs. Of course, as usual, we are at your disposal at any time and will gladly continue to work out suggestions on how you can achieve the lowest possible use of the precious raw material wood by using DEUFOL series packaging, alternative raw material use and our crate design software!

DEUFOL supports and relieves you with your current challenges

You currently need support with your logistics project and your company is affected by the extraordinary challenges in the market for wood? At DEUFOL, acting in partnership is not a marketing term, but the core of our customer orientation. For this reason, we not only want to keep you constantly informed about the current market situation and let you participate in the latest developments, but we are also happy to assist you at any time with the appropriate consulting services. Simply contact us now and we will find a suitable solution for you, which exactly meets your individual requirements.